Smaller/mid-cap deals

Smaller and mid-cap deals continued to represent the majority of transactions in 2023. 39 of the 57 firm offers were for public companies listed on AIM (68%) compared with 21 of the 46 offers in 2022 (46%). It is therefore unsurprising that the majority of firm offers (37; 65%) had a deal value under £250m, leaving 16 firm offers with a deal value between £250m and £1bn (28%), and only four firm offers with a deal value over £1bn (7%). The average deal value in 2023 was approximately 40% of that in 2022.

Industry preferences

UK-listed technology companies were subject to more firm offers than any other sector in 2023 (13; 23%). Pharmaceuticals, biotechnology and healthcare companies were also popular, accounting for 7 of the 57 firm offers (12%).

There was also high-profile consolidation in the UK investment banking and corporate broking market in the form of Deutsche Bank’s acquisition of Numis Corporation plc (now Deutsche Numis) and the merger of Cenkos Securities plc and finnCap Group plc (now Cavendish), with the Travers Smith team advising on both of these transactions.

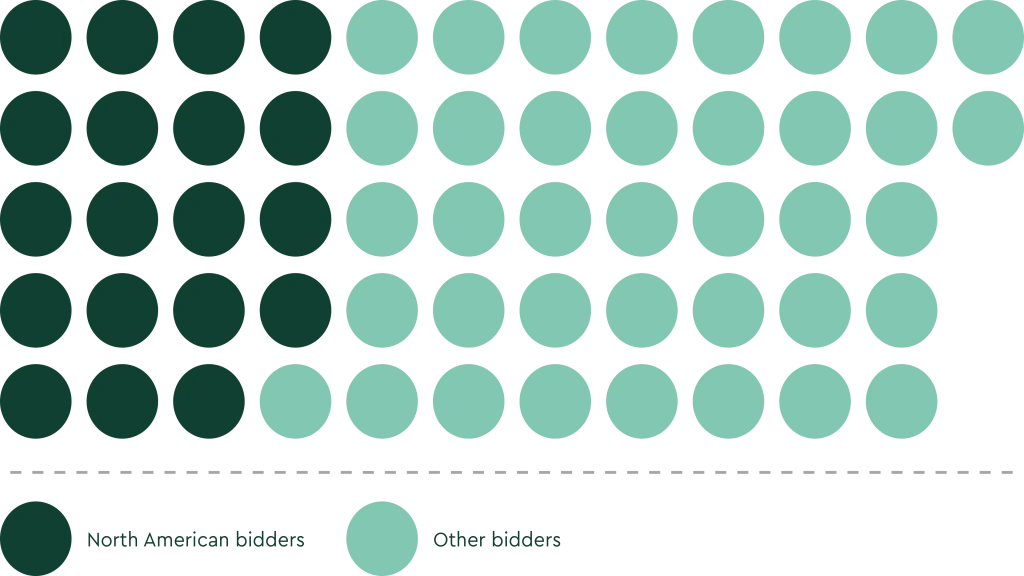

International bidders

UK public companies remained an attractive investment for overseas bidders, with bidders on 36 of the 57 firm offers (63%) having origins/ownership outside the UK. In particular, bidders from North America were behind 19 of the 57 firm offers (one-third), which is unsurprising given that UK equities have been trading at large discounts to their US peers. US bidders continue to be interested in UK technology companies, as shown by the firm offers made for Blancco Technology Group plc, Tribal Group plc and Sopheon plc.

Structure

A scheme of arrangement remained the preferred structure for public takeovers in 2023, when a firm offer is recommended by the target’s board. 46 of the 56 firm offers were implemented by way of a scheme of arrangement (82%), with the remaining 10 implemented by way of contractual offer.

Excludes the tender offer in respect of Holders Technology plc.

Strategic offers, P2Ps and consortium bids

Of the 57 firm offers made in 2023, 36 were backed by private equity or other funds (63%), compared to approximately one-third of firm offers made in 2022. Despite this increase in P2P activity, strategic bidders were more active in Q4.

There were five consortium bids announced last year, ranging from a deal value of £4.1m (offer for Velocys plc) to £4.5bn (offer for Dechra Pharmaceuticals plc), being the same number of consortium bids that were announced in 2022.

Competing bids

The number of competing firm offers notably reduced in 2023, down from four in 2022 to just one in 2023, being the firm offers from Apax Partners LLP and BC Partners LLP for Kin + Carta plc.

There were a few potential competing bid situations in the public domain, including the offers for The Restaurant Group plc, Instem plc and Network International Holdings plc, but only one firm offer was made for each company.

Acquisition finance

Despite ongoing challenges in the debt markets, a significant number of firm offers (28) were funded wholly or partly by debt (49%). There was an increase in bridging loans used at the time of the firm offer, which enable bidders to execute a deal quickly. We have also seen alternative credit funds continue to be active, particularly with private equity backed bidders. With interest rates seemingly stabilising, the cost of borrowing should hopefully become more certain in 2024 and bidders should see greater access to (relatively) liquid debt markets.

UK-listed funds

We also saw some interest in UK-listed funds, both from third party bidders and existing investment managers who saw opportunities in de-listing at a time when share prices were trading at a significant discount to the relevant fund’s net asset value (NAV), in some cases despite positive financial performance.

In September 2023, a firm offer was made for UK-listed Round Hill Music Royalty Fund Limited, which the target’s board unanimously recommended as it believed the offer provided shareholders with an opportunity to realise the value of their shares for cash at a significant premium. Similarly, the offer for Civitas Social Housing plc was unanimously recommended by the target’s board, even though it believed the offer undervalued the long-term prospects of the business, expressed by NAV.

We expect to see similar interest in this area in 2024, and our specialist listed funds lawyers are well placed to provide sector specific advice on these public takeovers.

Increasing shareholder activism

As public M&A activity continued through 2023, we saw a number of shareholders publicly or privately object to the price recommended by target boards, pushing them to seek higher or competing offers. For example, on the offer for Hyve Group plc a 11.6% shareholder published a statement that it considered the recommended offer price to significantly undervalue Hyve’s potential, a criticism that a number of institutional shareholders made to target boards last year. An increased and final offer price was subsequently announced with the shareholder’s support.

We also saw an increasing number of shareholder meetings have significant votes against: several bids ran close to the 75% support required (e.g. 75.95% on the offer for Instem plc and 75.14% on the offer for Finsbury Food Group plc) – and behind closed doors we saw a greater number that required persuasion to convert votes. Despite this, only four of the 57 bids were subject to increased offers.

The boards of The Restaurant Group plc and OnTheMarket plc also faced shareholder activism, with opposite intentions, and were ultimately acquired and delisted.

By April 2023, Oasis Management Company was a 12% shareholder in The Restaurant Group plc, which had suffered from difficult trading conditions following the COVID-19 pandemic. Oasis publicly released a letter to the board calling for significant change. After failed attempts to reject the company’s remuneration policy, remuneration report and the re-election of its remuneration committee chair at the company’s AGM, the board received an offer from Apollo Global Management, which was accepted by shareholders (including Oasis).

The board of OnTheMarket plc recommended an offer from CoStar Group Inc. on 19 October 2023, following which an investor (who was not a shareholder of the target) attempted to encourage shareholders to vote against the offer through a series of open letters. The investor also made a complaint to the Panel Executive alleging the transaction contravened General Principles of the Takeover Code. The Panel Executive ruled against the investor and, on appeal, the Chairman of the Hearings Committee dismissed the investor’s complaints, citing that he did not have a sufficient interest in the matter and, in any case, his complaint did not have a reasonable prospect of success. Shareholders accepted the offer.

Irrevocable undertakings

Shareholders (both directors and non-directors) continued to show their support for firm offers made in 2023 in the form of irrevocable undertakings to accept/vote in favour of the offer. Bidders on 20 of the 57 firm offers (35%) obtained irrevocable undertakings in respect of at least 30% of the target’s issued share capital.

Importantly, bidders continued to receive support from non-director shareholders, with 41 of the 57 firm offers (72%, up from 70% in 2022) having the support of non-director shareholders in the form of hard irrevocables (21 offers; 37%), semi-hard irrevocables (15 offers; 26%) or a combination of the two (5 offers; 9%).

Hard irrevocable undertakings will bind a shareholder even if a higher offer is made for the target by a competing bidder; semi-hard irrevocable undertakings will cease to bind a shareholder if a higher offer is made for the target by a competing bidder at a price at or above an agreed amount; and soft irrevocable undertakings will cease to bind a shareholder if any higher offer is made for the target by a competing bidder.